Whenever you are self-functioning and do not have all debt files available, you’re entitled to the lowest doc mortgage . Lenders that provide reduced doctor lenders will accept solution income confirmation tips such as bank comments, business pastime comments otherwise an accountant’s page rather than completed taxation production. not, extremely reduced doctor home loans will need increased put that try closer to 20% of the property price.

step one. Begin saving Carry out an everyday practice of setting aside typical savings for every spend cycle. Consider, when it comes time to try to get financing, providing research as you are able to sensibly carry out money can assist their loan application.

dos. Research just what regulators help is readily available When you’re an initial house customer, you may be qualified to receive bodies support. Assist for earliest home buyers varies anywhere between for each condition otherwise territory. It can be that towards you a federal government grant are limited getting newly created belongings or as much as a particular cost. It is quite value investigating any stamp duty exemptions otherwise concessions readily available.

3. Figure out how far you could potentially borrow Which have the lowest deposit home loan, their put matter can occasionally decide how far you could potentially use. not, your income will additionally sign up to the loan matter, that may set the newest plan for your residence search. There are various useful on the internet hand calculators that will help works out your credit potential based on how far you earn.

4. Get in touch with a dependable mortgage broker otherwise a low deposit mortgage lender For people who just have a tiny put and therefore are being unsure of and this loan providers provide reasonable put lenders, contact an excellent t rusted financial adviser otherwise large financial company . They’ll assist you from the mortgage possibilities for your requirements considering the savings, your income and you can a job history. They are going to additionally be in a position to recommend one regulators help you will get be eligible for. At this point, we should score pre-approval with the need loan amount upfront thinking about qualities.

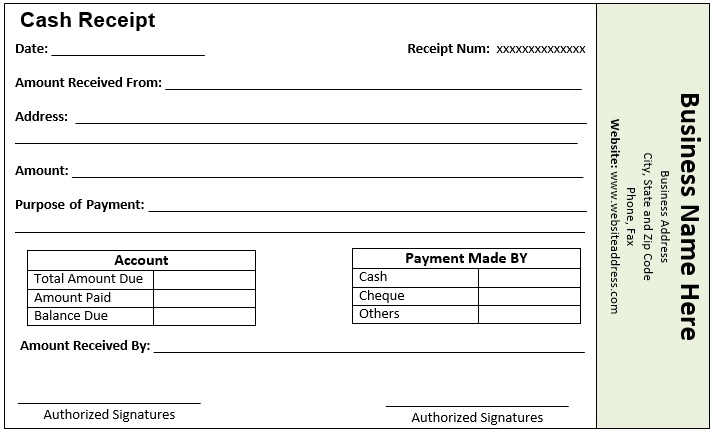

Your bank gives you a copy of one’s files, for you to store inside the a safe place having upcoming site

5. Pick property or investment property Manage a bona fide house broker locate a great house or investment property you are able. Be sure to make render subject to loans. Your own bank will have to agree the house prior to as long as you that have one unconditional financing recognition.

six. Provide any extra suggestions expected Don’t worry if the lender requires for additional help advice ahead of getting official mortgage approval. This is certainly popular, particularly when it’s got drawn you very long to obtain one finest assets. The financial institution may charge a fee a current pay slip otherwise offers report to confirm you are nevertheless in a position to deal with the borrowed funds.

seven. Signal the desired data and you can decide on the reduced deposit household financing Shortly after officially accepted to own a reduced deposit mortgage , all the functions should sign mortgage records. Take care to comprehend these cautiously. Once your financial has verified all files come in buy, they strategy a romantic date to settle for the seller. Everything you need to create is arrange to get the fresh tips and you will move around in!

How to evaluate reasonable put home loans?

There are various review other sites where you can compare the new https://paydayloancolorado.net/ponderosa-park/ rates of interest, possess, and needs for several fund and reasonable put mortgage brokers. It is essential to keep in mind that the lowest priced interest rate to your the market will most likely not fundamentally be the best loan for your items. When shopping for a low deposit mortgage, we should also consider the borrowed funds have readily available, if any mortgage will cost you would be put in the borrowed funds and you may the latest lender’s tune background, including.