Most recent Information

- Insurance coverage Law: The duty to disclose

- Home loans and Home loan Ties

- Tax Turmoil for Conveyancing

- A change which have a distinction

- Availableness Refuted

The purchase regarding immovable assets are going to be a challenging feel, specifically for very first-day buyers. When selecting how-to buy possessions, a buyer are up against a couple of options:

- Dollars Repayments and/otherwise

- Money on Financial

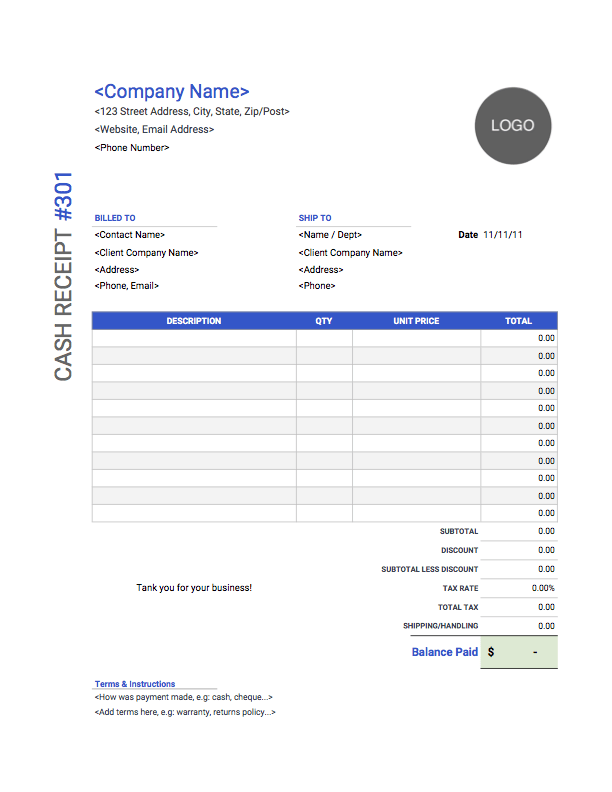

Basically, a buyer commonly use a combination of his very own cash including fund using their chose bank to help you buy a property. In the event your cost out-of property try R1 000 , a purchaser will get spend an excellent 10% put in bucks and you can finance the bill owing to a financial. Brand new R1000 purchase price will then be paid the following:

- A profit deposit from R100 into the transfer attorney trust account as invested; and

- The bill out of R900 is funded due to a lender by a mortgage agreement.

New purchaser can get strategy certain banks (or loan providers) to have quotations. The latest quotations on the financial simply be offered regarding the knowledge the consumer entry the various borrowing and you can investigations monitors of one’s bank. A bank will provide an offer and therefore sets out, amongst whatever else: the borrowed funds amount, the minimum monthly installment amount, the speed, the expression in addition to home loan bond amount along the assets.

On a technological element, some one have a tendency to relate to the mortgage contract while the bond interchangeably. Although not, both are very different principles. The mortgage number is the count the lending company tend to give to the newest consumer. In this situation the level of R900 . The fresh new buyer are needed to settle the loan count within the month-to-month instalments which are determined across the title of mortgage. The phrase away from a mortgage is normally 240 weeks or twenty years. To ensure the newest purchaser repays the mortgage number, the financial institution will check in a home loan bond across the bought property. The borrowed funds bond will act as safeguards towards cost of your financing by purchaser to the financial.

The connection count ount, which in this situation is R900 . However, the text matter ount if for example the value of was high enough. For example, in case the consumer pays a bigger put of R200 then balance becoming loaned by the bank would simply be R700 . If your property value the house or property try R1 200 (brand new purchaser possess loans in Canon City obtained a good package towards purchase rate the case today from the possessions market) then your customer might be able to get a bond to have R1 000 , according to the lending conditions of certain lender.

Mortgage brokers and you will Financial Securities

If this sounds like the way it is, the lending company tend to mortgage the fresh customer some R700 and therefore this new purchaser would need to pay from inside the month-to-month instalments until repaid entirely. But not, the home will receive a mortgage bond of R1 000 over it for example the new purchaser can get, in future borrow more cash about lender, as much as perhaps R1 000 without the financial having to register the next thread along side property. Although, new disadvantage away from joining a high bond, even though maybe useful in the long term, is that bond charge is actually payable to your bond lawyer into the total thread amount. Should your thread number is large, during the request of the consumer, the higher the text registration payment.

The goal of the mortgage bond across the property is so you can bring security on financial with respect to the financing arrangement toward purchaser. In the event the the latest purchaser defaults on the home loan contract by the failing continually to make straight monthly costs, the financial institution has actually safeguards. The loan thread along side property allows the financial institution in order to method the fresh new legal to obtain the property of the purchaser available in the event away from a breach of the property loan arrangement. Even though there is actually some detailed ways to go after, the latest gist of your own matter is that the lender will actually sell the property and you may deduct this new a fantastic loan amount (and notice) on the cost. In this way, the mortgage thread over the property obtains the fresh new repayment of your own loan amount as assets is available in the function out of a breach of the house loan contract of the customer.