Due to the fact app could have been submitted, the new handling of mortgage starts. Every piece of information into the software, instance lender places and you may commission records, is actually after that verified. The brand new processor examines the new Appraisal and Label Report checking getting assets problems that might require subsequent study. The whole mortgage plan is then assembled to have submitting to help you the lending company.

People borrowing derogatories, such as for instance late money, choices and/otherwise judgments need an authored cause

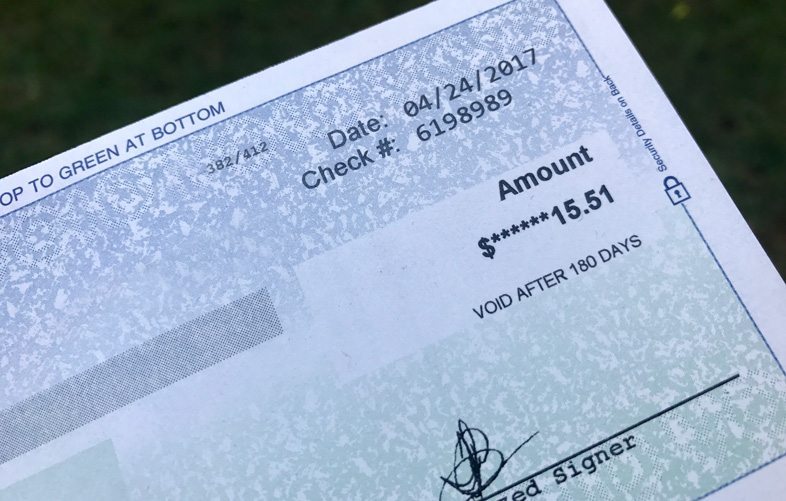

After you’ve completed the loan software, accepted the loan guess and you can conveyed your own intent so you’re able to go ahead we often request files from you to help you receive your loan recognition. Another statements are not a complete set of what is going to be required but are intended to make you specific notion of everything we will require away from you. Once you get to that phase of mortgage processes, we will give you a certain band of data that we will need to suit your sorts of financing. If you find yourself buying otherwise refinancing your residence, and you are salaried, just be sure to deliver the earlier in the day a couple of-decades W-2s and another week off pay-stubs: Or, while worry about-working attempt to supply the previous two-age tax returns. For individuals who very own local rental property try to provide Rental Arrangements plus the past several-years’ tax statements. If you would like automate brand new recognition process, it’s also wise to provide the earlier about three months’ financial, stock and mutual funds membership statements. Provide the latest copies of any stock broker or IRA/401k membership that you may have.

When you find yourself asking for bucks-away, you’ll need an effective “Access to Proceeds” letter out of factor. Render a copy of your own divorce decree in the event that appropriate. If you are not a Us resident, render a copy of one’s green credit (front and back), or if you aren’t a long-term resident give your H-1 otherwise L-step one visa.

Whenever you are obtaining a home Collateral Financing might you desire, along with the significantly more than files, to include a copy of the first mortgage mention and action from faith. These products will normally be discovered on your own home loan closing data files.

The majority of people trying to get a mortgage does not have to worry about the effects of the credit rating when you look at the mortgage procedure. But not, you will end up greatest prepared when you get a copy of your credit score before you apply to suit your home loan. By doing this, you could make a plan to fix one drawbacks before you make the app.

A cards Reputation refers to a consumer credit file, that’s made up of various credit revealing enterprises. Its a picture of the method that you paid back the companies you have lent funds from, otherwise how you possess met almost every other bills.

- Distinguishing Suggestions

- Employment Advice

- Borrowing from the bank Recommendations

- Public records

- Concerns

You will find four kinds of information about a card character:

When you have had borrowing difficulties, be prepared to explore them truthfully which have a mortgage top-notch exactly who will assist your written down their “Page out of Explanation.” Knowledgeable financial gurus discover there is certainly legitimate aspects of borrowing from the bank problems, such unemployment, disease, and other financial difficulties. If you had problems that was basically corrected (reestablishment away from borrowing from the bank), plus costs was in fact timely for per year otherwise way more, the credit may be believed satisfactory.

The mortgage industry is likely to would its very own words, and credit history is no other. BC home loan financing becomes their title on the leveling of your borrowing from the bank centered on things like fee background, amount of obligations money, bankruptcies, guarantee reputation, credit scores, etc. Credit rating are a statistical variety of assessing the credit chance of home financing application. The fresh new rating talks about next facts: prior delinquencies, derogatory percentage behavior, latest financial obligation profile, period of payday loan Munford credit score, kind of credit and you will amount of inquires.