Divorce case will likely be a challenging big date, and you can navigating financial choices adds an alternate layer regarding complexity in order to an currently mental condition.

Is an intensive guide to expertise what takes place to the financial during the a split up and exploring the options available. Dealing with home financing during breakup contributes complexity. Careful believed and you may proven tips can help manage like demands effortlessly.

One common method is to try to sell the relationship household and separate the newest continues. This one allows each party to move pass alone and you can reduce financial links on the possessions. Although not, it is required to consider costs such realtor earnings, fees, and you may prospective funding increases.

Re-finance Your Home loan

While in the divorce process, if one companion wants to secure the household, capable re-finance the loan within their name simply (this is basically the calculator). That one takes away the other partner’s duty with the mortgage however, demands being qualified considering individual income and you may creditworthiness. It is crucial to inform our house label so you’re able to reflect just control immediately after refinancing.

Spend Him/her for their Display regarding Guarantee

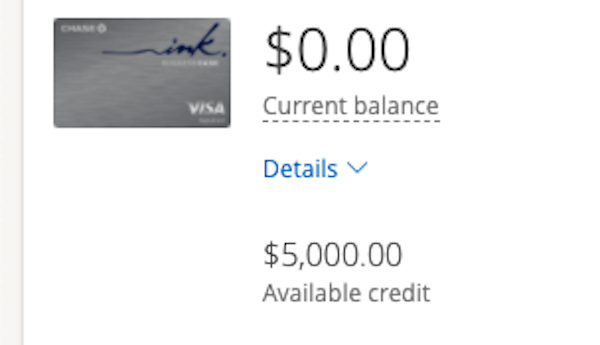

An alternative choice regarding the lifetime of divorce or separation is for one lover to find from other’s express of security in the home. You can do this courtesy a money-out refinance, where in actuality the retaining companion takes out a special financing getting a installment loans online Minnesota highest total safeguards the new buyout. As an alternative, a house equity credit line (HELOC) or family guarantee loan is regarded as if there is sufficient guarantee readily available.

Separation & FHA Improve Refinance

If you already have an enthusiastic FHA mortgage to the home, you can use new FHA Streamline Re-finance to remove a debtor as opposed to checking domestic security. However, the remaining partner need to reveal that they’re making the entire mortgage repayment for the past six months. An improve Re-finance is perfect for those who have started broke up for around six months. However it is perhaps not better if your settlement agreement requires you to answer their separation and home loan condition right away.

Splitting up & Virtual assistant Improve Refinance

Va loan people is also improve a divorce case-related mortgage changes. The brand new seasoned mate need remain on the loan. Whether your experienced renders, additional lover may need to refinance for the another mortgage. If for example the leftover mate qualifies to own an excellent Va loan, they might thought a cash-away solution. This lets them borrow up to 100% of house’s worthy of, possibly paying off the brand new departing partner’s show for each the latest breakup contract.

Financial and you will Divorce proceedings Factors and Ramifications

Household Security Assessment: A specialist assessment is needed to dictate the latest residence’s value and collateral, crucial for making informed conclusion.

Tax Effects: Financing progress fees get incorporate with respect to the revenue otherwise buyout scenario. Wisdom tax rules connected with assets department is very important.

Protecting Borrowing from the bank: Each party would be to focus on maintaining good credit during and after the fresh new divorce case, because financial measures can affect creditworthiness and you will upcoming loan qualification.

Even more Understanding

Refinancing Challenges: Qualifying to own a great refinance centered on individual money and you will borrowing can feel an obstacle for almost all divorcing some body.

Offering Factors: Whenever you are selling the home brings a clean crack, additionally, it pertains to in search of the life arrangements and you can coordinating the new business techniques.

Professional Recommendations: Consulting with economic advisers, real estate agents, and you can courtroom professionals could offer valuable skills and help create told behavior.

To conclude, navigating mortgage solutions throughout the splitting up requires careful consideration off financial effects, legal aspects, and you can individual needs. For every single choice has its positives and negatives, and choosing the right path depends on circumstances eg economic balances, worth of, and preparations. Looking to professional advice and you may knowing the possibilities empower divorcing somebody and then make voice monetary behavior in this difficult day. Confusing, right. Get more solutions here.