Share Which

Towards price of university continuing to help you skyrocket, moms and dads are now appearing not as much as most of the rock and difficult spot to try and see tips to fund the student’s college degree.

One of those options available is the equity on your own household. Particular mothers, specifically those who understand their child are likely to not located need-oriented financial aid, envision experiencing their home security to mitigate otherwise entirely lose the necessity for college loans.

It is a tool, Not a method

When you yourself have founded security of your house, this one are another type of unit on product package that you might use to buy college.

Of several moms and dads are starting to find out that there is no silver bullet to pay for university; in fact, very household will have to have confidence in a mixed approach you to encompasses many monetary auto and you may equipment.

Whether it is home security, a great 529 Bundle, an excellent Roth IRA, cash well worth term life insurance, a brokerage membership, student education loans, scholarships and grants, otherwise some all of these, of a lot mothers need certainly to turn to a method out-of combining monetary devices regarding strongest and you can efficient way playing this new highest price of college. This might be particularly the circumstances whether they have several, three, otherwise five students which they should upload to college.

It is difficult to explain new how-to to have utilizing home collateral because the most of the family members is special, and that strategy greatly hinges on time and circumstance. Hence, this article is a reduced amount of a great how-to plus regarding a radio for the next prospective product to simply help mothers purchase university.

Exploring the Advantages and disadvantages of employing House Guarantee getting College or university

Today, an instant word-of alerting: like any monetary device that you could wish to use to pay for your own little one’s college degree, there are inevitably pros and cons.

Occasionally, property security loan or a house security line-of-credit can be the least expensive money that you can obtain. As to why? The loan try secured of the guarantee of your house.

Excite build an informed decision and consider all facts your can think about interest levels, charge, the weight regarding chance, projected duration of old age, installment liberty, an such like.

Gauge the pros and cons before signing your label toward the fresh dotted line and you may speak to your monetary elite group to help you query if it approach may be effectively for you.

Masters of employing Domestic Security to cover College

1) The rate is generally less than a national student loan, a private education loan, and/or a personal bank loan.

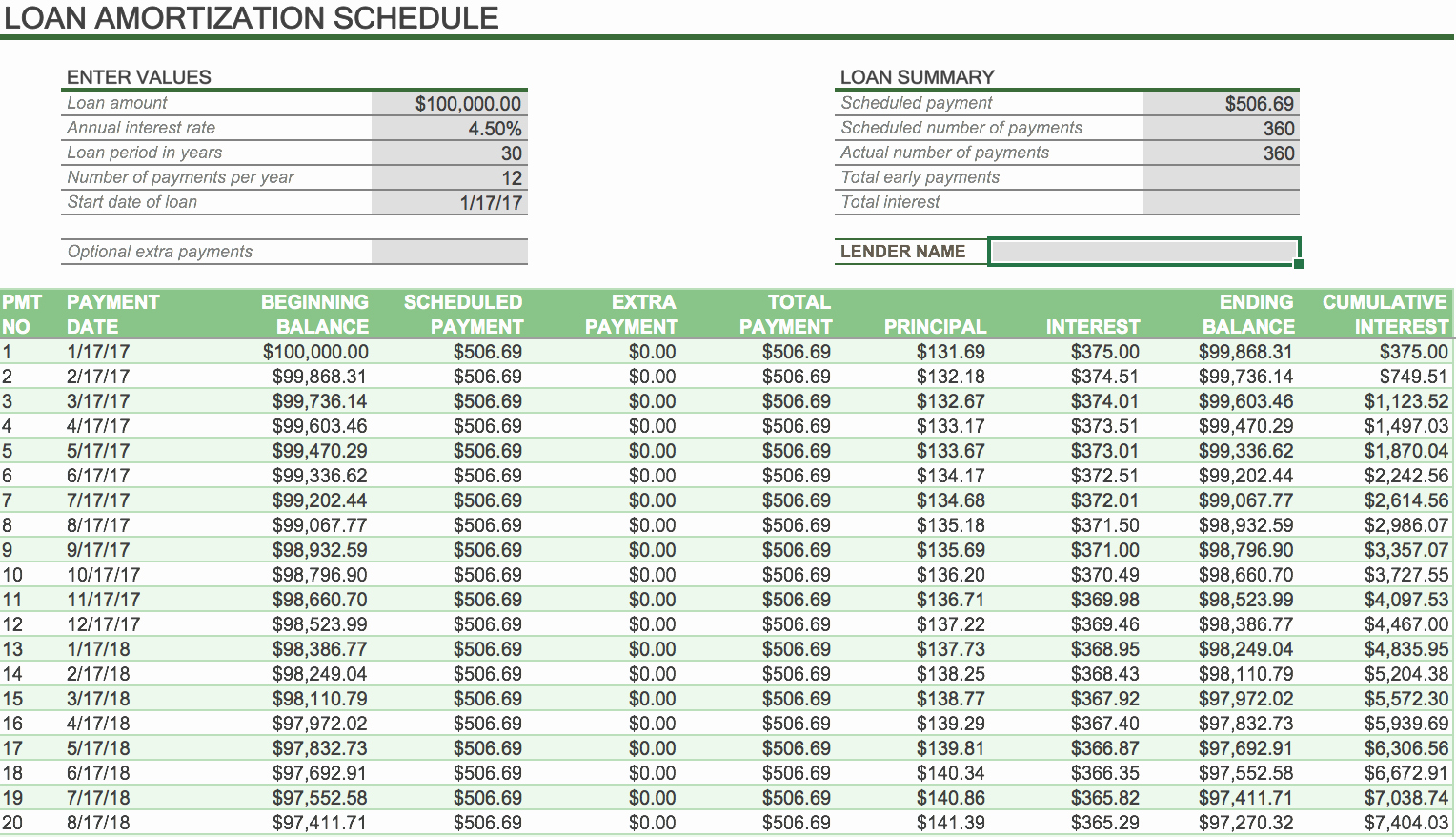

2) You’ve got the ability to pay back your loan more a long time frame. For example, an excellent HELOC, or house equity line of credit, will enables you ten years to attract currency and you can two decades to blow they straight back.

Kicking the latest debt normally subsequently simply means you’ll have to manage they after as well online personal loans WY as longer. Very once more, you will want to adequately weigh your possibilities.

Downsides of employing Family Security to cover School

Of numerous parents is actually naturally bashful on using their domestic security having university expenditures. Think of every one of these anybody whoever household foreclosed inside 2007-2008, when they took a lot of guarantee out of their home for the 2004 and you will 2005? You will find built-in exposure right here.

- Limited installment choices

- Zero taxation deduction towards interest

- Adjustable rates

- Prepayment penalties (for the majority of)

- Zero freedom during financial hardships. Could cause under water.

- If you were to think you may want to be eligible for educational funding, experiencing your property security could possibly get damage their qualifications.

Always perform your own research by-doing thorough look and you will asking debt coach to see if which device is useful having your. It doesn’t work with visitors, however, if it suits in your monetary construction, it can be a game-changer!

Summary

Basic, make sure to fatigue all lower and secure choice. Discover most of the forms of financial aid. If you aren’t likely to be eligible for you prefer-oriented support, take a look at colleges offering a great amount of quality aid and you will/otherwise keeps lower sticker pricing. Encourage your youngster become uniform and you will relentless into the trying to get individual grants. Think society university. Educate yourself on the college loans industry and check out having you’ll be able to dangers and hidden charges.

In which would you realize about such subject areas? There are numerous worthwhile information ranging from pupil finance to finding best college match toward the Tuition Cents Web log otherwise our very own Information page.

At some point, family security will be a helpful way to avoid college loans otherwise high priced Mother-In addition to fund with regards to the family members’ state.

Once more, I want to fret the danger. If your child cannot pay their figuratively speaking, their credit requires a knock, and face an uphill rise. If you can’t pay off your residence security loan otherwise range of borrowing, you can lose your property. Often be cognizant of facts.

Everybody’s State is exclusive

I realize some of you try reading this and you can convinced What is the bargain? The guy provides claiming it is a good equipment then again the guy stresses the dangers and you will means perhaps not particularly a tip.

You will find an obvious account you. Until we, as financial advisors, understand your position, we can’t help you establish a personalized monetary package that surrounds college or university and you can suits you.

Thus, we recommend ending up in a dependable economic coach while uncertain tips need domestic collateral into your college resource plan-otherwise if or not you are able to it to begin with.

The audience is in the an unusual and you can erratic time nowadays, so if you try feeling concerned or overrun about the college or university investment processes, go ahead and reach out to all of us having a free school preparedness consultation.