Benefits instance no off without personal home loan insurance coverage (PMI) can be worth the fresh new slight escalation in records more a timeless financial.

Considering one pointers, you will discover for people who be eligible for a given loan

So you can located your Certification of Qualification getting Va loan positives, attempt to submit their Obtain a certification off Qualifications (Virtual assistant Setting twenty six-1880), as well as your Services Listing (DD-214).

This type have to be complete and you will sent in which have an assistance list (DD-214) if you’d like to see a certificate from Eligibility.

Once you have completed their function, fill in they along with your Solution Number (Form DD-214) so you’re able to a regional Eligibility Center.

New DD Form 214 serves as their evidence of army provider. If you don’t have your DD Setting 214, you could demand it from the Federal Professionals Facts Center, having fun with a simple Setting 180 (Demand About Military Ideas).

Upcoming, the procedure is much like a classic financial: remove your own credit reports, shop around getting pre-approvals and you may advantageous rates, build also provides and you will indication a contract, enjoys appraisals done, and summary a lot more records prior to getting the newest important factors and you may getting into the new family

This step pertains to half a Moodus loans dozen essential actions: looking a great Virtual assistant-recognized lender, pre-qualifying for a loan, trying to find your residence, drawing within the get deal, getting the possessions appraised by the Va, and finalizing the borrowed funds.

- The newest applicant must be a qualified seasoned who has got readily available entitlement.

- The loan have to be getting a qualified objective.

- Brand new veteran need to invade otherwise plan to invade the house because the property within a reasonable period of time shortly after closing the fresh financing.

- The newest experienced should be a suitable credit exposure.

- The money of experienced and lover, or no, should be been shown to be stable and sufficient to meet with the home loan repayments, cover the costs from owning a home, take care of most other debt and you will expenses, and just have enough left-over for loved ones help.

Before you begin the program techniques, it is smart to score a copy of your own credit report. This is extracted from among the many about three major credit bureaus: Experian, Equifax, and you may TransUnion. Once the private credit reporting agencies may charges to pull your own declaration, you can get your credit report off all the around three bureaus for free, shortly after annually, through the FTC’s Yearly Credit report system.

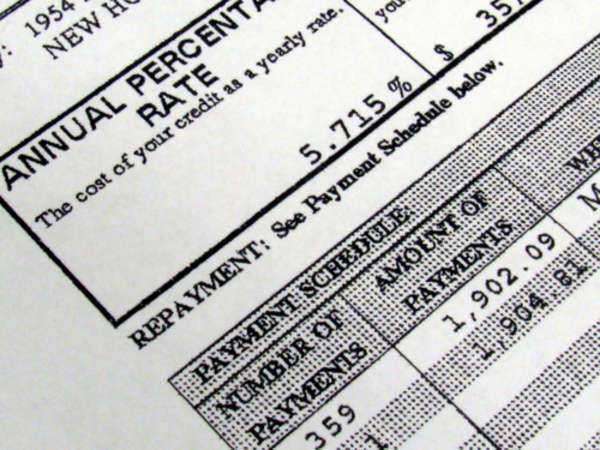

Once you’ve gotten your credit score, the next phase is to obtain a good Virtual assistant approved lender. A loan provider is also point out any borrowing dilemmas you could have and give you financing guess. Shop aroundpare other lenders’ closing costs (over and above the price of the home) sustained from the buyers and suppliers for the move possession from a home (referred to as settlement costs) or any other fees.

Army makes it easy to track down Va recognized loan providers – only use the Brief Function and become paired that have as much as four lenders, where you can score pre-certification and you will examine cost.

Pre-qualifying for a financial loan is the best treatment for determine how much borrowing energy you’ve got. Pre-being qualified concerns enabling your own lender know what your earnings and possessions was. Observe that pre-qualifying only gets a quote of the level of homeloan payment you can afford, according to the information your promote. When you’re pre-qualifying is not a requirement, it is imperative. Instead of pre-being qualified very first, you may find on your own looking at home you won’t necessarily manage to manage. Vendors also are a great deal more likely to come across a deal out-of a beneficial pre-accredited visitors than you to rather than an effective pre-degree.