A current survey unearthed that across the second a couple of years, residents desired they are going to purchase an average of $7,746 into the domestic repair and you will update programs.

Yet not, towards worries out of a growing market meltdown and you may a challenging savings, of numerous inquire the way they will pay for such solutions. 34% out of respondents said they propose to have fun with credit cards, that is a very nearly 5-fold rise in mastercard incorporate as compared to previous year’s findings.

Due to the fact property update elite, knowing the advantages and disadvantages of financial support a job with a good home improvement financing versus bank card is reputation your since the a helpful help guide to consumers, that may help you win way more ideas. Continue reading for more information on https://www.cashadvanceamerica.net/personal-loans-nh/ advantages and you can drawbacks out of customers using credit cards to finance a task to you.

Credit cards: The advantages and Downsides

- Convenience: Playing cards render unparalleled convenience with respect to and make orders, and the individuals pertaining to domestic home improvements. Your potential customers can easily pay for services with a good swipe otherwise a spigot.

- Zero Equity Expected: Credit cards essentially do not require guarantee, in place of home improvement fund. This means consumers need not place their property otherwise most other worthwhile property at stake so you can safer money.

- Interest-Free Months: Specific playing cards have an interest-100 % free introductory several months. During this time period, your potential customers can make instructions as opposed to running into interest fees when they pay the equilibrium completely monthly.

- High-Interest rates: Credit cards have a tendency to carry large-interest levels, especially if a balance try maintained not in the appeal-totally free months. Over time, this type of appeal fees can collect and significantly boost repair will set you back.

- Limited Borrowing limit: The credit limit in your customer’s cards might only shelter region of its recovery expenditures, forcing them to use numerous cards otherwise look for more financial support.

- Minimal Monthly premiums: Playing cards provide self-reliance, even so they require also consumers making lowest monthly payments, that may end up being a weight if you’re unable to pay back the new equilibrium swiftly.

- Operating Fees: Of numerous credit card operating companies charge organizations a charge so you’re able to procedure this new deals.

Do-it-yourself Fund: The advantages and Drawbacks

- All the way down Rates of interest: Do-it-yourself finance generally speaking bring straight down rates as compared to borrowing from the bank notes. This will result in ample deals inside attention will set you back across the life of the loan.

- Fixed Installment Words: With a house improve loan, your web visitors get a predefined cost agenda, making it simpler so you can budget for the fresh new project’s costs over the years.

When people try to select from a house upgrade financing compared to. playing cards for their renovation enterprise, it eventually depends on the financial predicament and tastes. Handmade cards offer comfort and you may self-reliance however, feature high attention prices, when you’re home improvement loans provide straight down pricing and extreme loan number however, require collateral.

For the people and come up with a knowledgeable choice, it’s a good idea to see an economic coach or lending professional to search for the finest funding selection for their needs. That’s where a talented specialist financing credit companion stages in. Armed with an in-breadth comprehension of a, these types of creditors render more than simply investment. They supply a collaboration one tries to know and appeal to the requires regarding do-it-yourself organizations as well as their people.

Mate Send that have Salal Dealer Head

We form teams with builders nationwide to provide their clients which have affordable resource for various solar and home improvement ideas.

We could give some of the most competitive cost and you can broker charge given that our company is section of an associate-possessed credit commitment. It means all of our winnings come back to our people-and providers lovers-by way of down cost and a lot fewer charge.

How to start Giving Salal Broker Capital in order to People

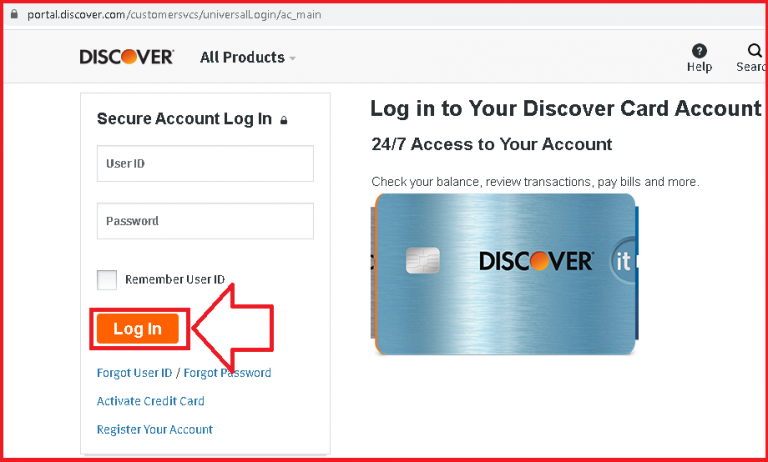

We are intent on helping your online business expand that have timely investment moments and you can personalized assistance regarding a loyal and you may knowledgeable cluster out of credit experts. To get started, all of our dealer application techniques needs such records: