Buying your first home inside the Canada as a newcomer is a keen enjoyable milestone plus one of the biggest conclusion you are going to make.

Because of the knowing the world of Canadian mortgage loans, you will be finest willing to achieve your homeownership requirements on your own the newest country.

Contained in this one or two-region series, we will talk about the most areas of Canadian mortgage loans beyond simply the interest prices, which will assist you to create advised behavior when financing the earliest household. We will dive to the important factors which will help profile debt travels, helping you create the details to navigate the process properly.

Facts Home loan Basics:

Knowing the basic rules of mortgage loans is very important before embarking on your house to get trip. Listed below are tips to understand:

What exactly is a mortgage?

Home financing is a loan that have focus provided by a lender to invest in the acquisition in your home therefore shell out it off over the years. Which financing was secure by the domestic you get.

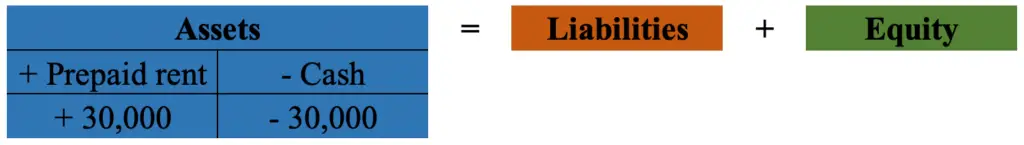

A deposit was a portion of the residence’s price which you pay upfront. It represents their first guarantee regarding the assets.

What do terminology eg Amortization several months and Financial Name suggest?

The new Amortization Several months ‘s the overall period of time you’ll need for you to pay back your mortgage totally. An everyday amortization period is twenty five years. The Mortgage Label, in addition, describes amount of time you are dedicated to a home loan rates, lender, and associated criteria, always ranging from six months in order to ten years.

Should you get a mortgage, there will be possibilities on what appear to you make money. It’s advisable month-to-month, bi-each week, a week otherwise an accelerated payment agenda, like biweekly accelerated the more or less same in principle as and also make you to more commission from year to year instead of biweekly repayments. Deciding on the best volume make a difference the fees strategy and you may overall appeal costs. Definitely ask your financial expert what tends to be proper for you.

Exactly what are the different varieties of home loan pricing?

Fixed and you will Varying Speed Mortgage loans: Repaired rates mortgages give a routine interest rate on name, whenever you are variable rate mortgages has costs one to vary in accordance with the primary rates of lender.

Discover and you can Closed Mortgage loans: An open Mortgage allows you the fresh freedom to put prepayments on the mortgage financing when up until it is totally paid down. It could features a top interest rate by additional prepayment flexibility and certainly will become converted to one repaired speed term more than your remaining term, at any time, without any charge. A shut Home loan only succeed prepayment up to a maximum matter because the portion of the initial dominant count on a yearly basis if you don’t prepayment charges will use.

Beyond Interest rates: Things to consider Before Finalizing Your Mortgage

1) Mortgage small print: Cautiously feedback this new terms and conditions each and every mortgage alternative. Find have instance prepayment benefits, portability (the ability to transfer the loan to a different property), and you will liberty inside the payment dates.

2) Closing costs: And the deposit, it’s also advisable to cover closing costs, which includes courtroom costs, property assessment, homes transfer taxation, and other associated expenses. Expertise this type of will set you back will help you bundle your budget effortlessly.

3) Home loan standard insurance: If for example the downpayment try less than 20% of your own home’s purchase price, mortgage standard insurance coverage are required. That it insurance policies covers the financial institution in case of default but it is an added cost you have to spend.

4) Pre-approval process: Obtaining a mortgage pre-approval also provide clearness about how far you can obtain and you can assist streamline your house purchasing process. They tells providers that you’re a serious customer and you will can also be enhance your discussion fuel.

Learn the Financial Basics with TD Financial Gurus:

Navigating the field of mortgage loans can be state-of-the-art, specifically for newbies that happen to be and very first-date homebuyers. TD understands it and provides loyal mortgage specialist who’ll offer guidance and help on the techniques.

He or she is here to assist if you’d like let knowing the financial principles, like down payments, amortization periods, commission wavelengths, and different kinds of mortgage loans offered.

They’re able to also have your with of good use resources to be certain your has a powerful understanding of the borrowed funds techniques and getting pretty sure on your own possibilities. Take advantage of this help to make your home to find trip a smooth and you may effective you to.

Click here getting Area Two of so it Mortgage loans 101 show so you can find out the essential actions you need to take with the financial support your home when you look at the Canada.

As to the reasons Prefer TD?

TD features a happy history of getting financial ways to Canadians for more than 150 age. TD in addition to brings an effective century of experience permitting newbies browse the novel demands of your Canadian bank system.

With over a beneficial thousand branches, a track record to own perfection inside economic characteristics, and the capacity to along with last in more than simply sixty more dialects, TD happens to be one of the primary and most trusted banking companies inside Canada, today offering sixteen million Canadians.

TD has the benefit of online service and you can resources of appeal so you can beginners into subject areas such as for instance banking. principles, transferring to Canada, credit rating essentials, and. TD try discover extended period for your benefit. TD keeps tens and thousands of ATMs across Canada to help you capture care of your everyday banking quickly and easily.

Happy to Bank?

Book a consultation to talk that have an effective TD Individual Financial Associate about the TD New to Canada Banking Plan. You could potentially publication on line straight away, or look at the TD website to get the full story.

Judge Disclaimer: Suggestions provided by TD Bank Category or any other source within this article is assumed become perfect and legitimate whenever put on the site, however, we can not make sure it is right otherwise over otherwise current at all times. Pointers on this page is for informative motives merely which is perhaps not designed to promote financial, legal, accounting otherwise taxation information and payday loans with no credit check in Haleyville AL cannot getting depended up on when you look at the one value. This article is to not ever getting construed because the a beneficial solicitation so you’re able to pick. Services and products of the TD Lender Class are just considering inside jurisdictions where they truly are lawfully offered for sale. All of the products and services are subject to the latest terms of the fresh new applicable arrangement. All the information in this post was subject to change with no warning.