- education, travel

- long-title care and attention and you may/otherwise much time-name proper care insurance coverage

- monetary and you may property taxation agreements

- gifts and you can trusts

- to order life insurance policies

- or any other need you really have.

- how old you are during the time you get the mortgage,

- the opposite financial system you select,

- the worth of your house, latest rates of interest,

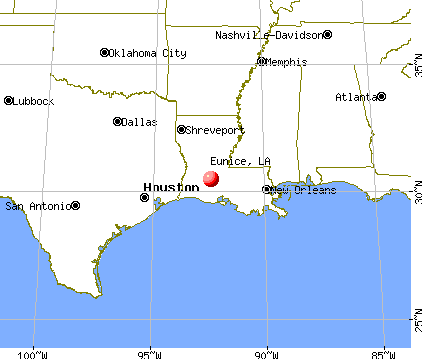

- as well as specific items, your geographical area.

When there is lack of guarantee to cover the financing, the insurance suits the mortgage by paying the latest deficit

In most cases, the newest older youre and the higher the collateral, the bigger the opposite financial work with might possibly be (up to certain restrictions, occasionally). The reverse mortgage must pay off people an excellent liens facing your own assets before you can withdraw extra loans.

age. the brand new borrower sells, movements aside forever otherwise becomes deceased). At the time, the bill out of lent money arrives and you may payable, most of the a lot more guarantee about possessions belongs to the owners or their beneficiaries.

The expenses on the providing a face-to-face financial resemble individuals with a traditional mortgage, for instance the origination fee, assessment and you can check costs, identity plan, home loan insurance rates and other normal closing costs. Which have a face-to-face financial, each one of these will set you back is funded within the home loan just before their detachment of most fund.

You must be involved in another Borrowing from the bank Guidance training having an excellent FHA-acknowledged specialist at the beginning of the application loans in La Fayette procedure to possess an opposing financial. The fresh new counselor’s work is to coach you regarding the any mortgage choice. Which counseling lesson was at no cost toward borrower and you will can help you privately otherwise, even more typically, over the telephone. Immediately after finishing so it counseling, you’ll discover a guidance Certificate regarding the post and therefore need be added within the reverse home loan software.

There are three reverse real estate loan facts offered, the fresh new FHA – HECM (Family Collateral Conversion Mortgage), Federal national mortgage association – HomeKeeper, in addition to Cash Membership apps

3) a line of credit; otherwise a combination of a credit line and you can monthly premiums. Widely known alternative, selected of the more than sixty percent from borrowers, is the personal line of credit, that allows one to mark with the financing continues any kind of time day.

Keeping profit an opposing mortgage credit line in the most common states will not count due to the fact a secured item having Medicaid qualification because this will be believed that loan and not a resource to own Medicaid purchase down. But not move the money to a good investment or even a lender account perform show a valuable asset and you can do lead to a spend down needs. Take note yet not that determining between exactly what percentage of opposite home loan continues might be measured as that loan and you can exactly what part as an asset isnt a straightforward grayscale decision. It is best to rating a viewpoint out-of an elder lawyer in your condition.

In the event that a senior resident decides to pay off people portion of the appeal accruing facing their borrowed finance, the fresh new percentage of this focus could be deductible (just as people home loan focus may be). An other home mortgage will be offered to a senior resident to attract on as long as that person resides in our home. And you may, in some instances, the lending company increases the overall quantity of the new personal line of credit throughout the years (in the place of a traditional Domestic Guarantee Line whoever borrowing limit is made within origination). If a senior citizen resides in the house or property up until the guy or she passes away, their home valuation will be shorter by count of your own loans.

On loss of the last borrower or perhaps the business off your house, the borrowed funds was repaid out-of collateral at your home. People left collateral (that is certainly the way it is) would go to brand new heirs. The majority of reverse mortgages will be the HECM financing that is protected by FHA financial insurance. Having a beneficial HECM mortgage, the bank can never already been pursuing the heirs meet up with this new financial responsibility.