- education, travel

- long-title care and attention and you may/otherwise much time-name proper care insurance coverage

- monetary and you may property taxation agreements

- gifts and you can trusts

- to order life insurance policies

- or any other need you really have.

- how old you are during the time you get the mortgage,

- the opposite financial system you select,

- the worth of your house, latest rates of interest,

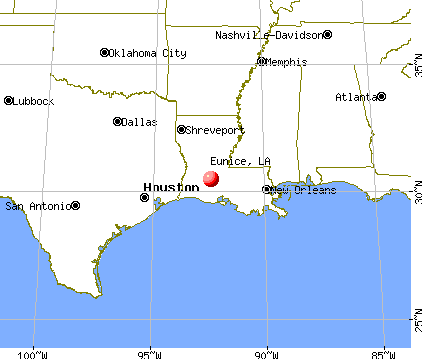

- as well as specific items, your geographical area.

When there is lack of guarantee to cover the financing, the insurance suits the mortgage by paying the latest deficit

In most cases, the newest older youre and the higher the collateral, the bigger the opposite financial work with might possibly be (up to certain restrictions, occasionally). The reverse mortgage must pay off people an excellent liens facing your own assets before you can withdraw extra loans.

age. the brand new borrower sells, movements aside forever otherwise becomes deceased). At the time, the bill out of lent money arrives and you may payable, most of the a lot more guarantee about possessions belongs to the owners or their beneficiaries.Continue reading